Unlocking the Untapped Potential The Power of OCO Orders

Summary

- Introduction

- Unveiling the Essence of OCO Orders

- Understanding OCO Order Types and Variations

- Entry OrderTakeprofit OCO Orders

- Breakout OCO Orders

- Implementing OCO Orders Practical Strategies and Techniques

- Targeting Price Breakouts

- Deciding Between Two Cryptocurrencies

- Executing OCO Orders Practical Considerations and Best Practices

- Advantages and Considerations

- Conclusion Unleashing the Power of OCO Orders

- Final Verdict

- Frequently Asked Questions

- What exactly is an OCO order in trading?

- How do OCO orders benefit traders?

- Can OCO orders be used in all markets?

- What happens if prices move quickly and both orders of an OCO are triggered?

- Do OCO orders expire?

- Can I set multiple OCO orders on the same stock?

- Are OCO orders guaranteed to be executed?

- Is there a risk of slippage with OCO orders?

- What’s the difference between OCO and bracket orders?

- How do I decide on the price points for my OCO orders?

- Related Video

- Frequently Asked Questions

Introduction

You know, when I first got wind of One-Cancels-the-Other (OCO) orders, I gotta say, my curiosity was piqued. So, what’s the big deal with these? Well, let’s dive right in. An OCO order is kinda like having a Plan A and Plan B in your trading strategy. It’s a pair of orders stipulating that if one order gets fulfilled, the other gets canceled, like magic! Imagine you’ve got your eye on a juicy cryptocurrency, and you’re itching to make a move. You place an OCO order to either snatch it up at a desirable dip or sell it off before it tanks further. It’s pretty nifty because this strategy puts you in a sweet spot—either you’re raking in profit or cutting potential losses short.

Now let me tell you, the beauty of OCO orders lies in their flexibility. If the market swings one way, you’re all poised to hop on the profit train. On the flip side, if things go south, your exit plan is locked and loaded. No fretting over constantly watching the market. You’re covered both ways, which brings a whole lotta peace of mind, trust me.

And here’s a thought—having this ace up your sleeve means you’re playing the market like a pro, leveraging opportunities while managing risks. Honestly, it feels like setting up a chessboard where you’ve thought two moves ahead. You’ve got to admire the sheer elegance of having a fallback that automatically kicks in, saving you the heartache of manual miscalculations. It’s pretty clear, OCO orders could be a real game-changer in the way you handle your crypto escapades.

Unveiling the Essence of OCO Orders

Well, I gotta tell ya, OCO orders, they’re a pretty nifty piece of the trading puzzle, wouldn’t you agree? It’s like having a strategic sidekick in the wild world of trading. Every time I set one of these up, I feel like I’m covering all my bases—like being ready for a curveball that the market might throw my way at any second.

So when we talk about unveiling the essence of these orders, think of it as setting up a plan A and a plan B. And, by some kind of trading magic, once plan A runs its course, plan B just disappears—poof!—like it was never there to begin with. What I love is the control it gives me over my trades, you know? I set my target price, sure, but I also hedge my bets with a stop limit in case things go south. It’s all automated, so I don’t have to keep one eye glued to the screen.

And the best part? It’s a downright lifesaver when the market’s as fickle as the weather. I can go catch some z’s or grab a coffee, and my OCO order has got my back. It’s taking care of business, ensuring I either hit that sweet profit mark or duck out before I take a serious financial plunge. It’s like having an autopilot—for your investments!

Understanding OCO Order Types and Variations

Alright, so let’s dive right into the nitty-gritty of OCO order types and what makes them tick. Basically, an OCO order is like having a safety net and a victory lap all rolled into one sweet deal. It’s like being at a buffet and getting your favorite comfort food, plus the dessert you’ve been eyeing, without overdoing it.

Now, there are a few variations to keep in mind. You’ve got your basic OCO setup, which is the bread and butter for traders who don’t like losing sleep over the “what ifs.” But then there are the more complex iterations. Think of these as your customizable orders that can be tailored to the nitty-gritty of your trading strategy—like adding those extra toppings on your pizza that make it just perfect for you.

For instance, some traders get really fancy and add conditional factors that adjust their stop-loss orders based on market changes. It’s like setting your home thermostat to change with the weather outside, keeping things comfy no matter what’s happening. And sometimes, these variations include trailing stops that tie your stop-loss order to a dynamic marker, ensuring you lock in profits without bailing too early—kind of like holding onto a winning lottery ticket until it hits just the right jackpot.

Now, it’s essential to wrap your head around these different flavors because each one can add a distinct edge to your trading strategy. Just remember, while they can be pretty awesome, there’s no one-size-fits-all here – it’s all about what works for your particular style and risk appetite. It’s like picking the right gear for a hike; you’ve got to think about the terrain ahead and what you’re comfortable carrying.

Entry OrderTakeprofit OCO Orders

So, I’ve gotta tell ya, when it comes to trading, I like to play it smart – and that’s where come into play. Think of it like setting up a chessboard; you’ve gotta have a strategy. I set my entry orders at specific price points, you know, just where I reckon the market’s gonna swing in my favor. But here’s the kicker – I pair it with a take-profit order. That’s my ticket to securing the bag when the price hits my target.

And let me be clear, this isn’t just some run-of-the-mill tactic. It’s about making the market work for you, squeezing out profit, and ducking out before the tides turn. My heart kinda does a little victory dance every time those orders kick in and the profits roll. There’s nothing like seeing your plans unfold just the way you imagined. It’s like watching your favorite team nail the perfect play and score, right when they need to.

But it’s not all sunshine and rainbows; you’ve got to stay sharp. This approach demands that you understand the market like the back of your hand. When it’s time to set these OCOs, I get this rush – it’s thrilling and unnerving all at once, like walking a tightrope. Every trade’s a balance between risk and reward, and getting it right – that’s what separates the pros from the newbies. But hey, that’s the game, and I’m all in.

Breakout OCO Orders

Ever stumbled upon a neat trading trick for when the market seems to be on the cusp of a major move, but you’re not quite sure which way it’ll swing? That’s where Breakout OCO (One-Cancels-the-Other) orders come into play. They’re like my secret weapons when I’m eyeing a currency pair that’s flirting with support or resistance levels. Imagine setting up two orders, one just above the resistance level and another just below the support level. The beauty is, once one triggers, the other gets canceled automatically – it’s a flawless way to jump on the bandwagon as soon as the market tips its hand.

I gotta tell ya, incorporating Breakout OCO orders into my strategy, makes me feel like a maestro, orchestrating my moves in harmony with the market’s symphony. And when that price breaks out, it’s like hitting the high note – pure adrenaline! But it’s not just about riding the thrill; it’s about precision. Why bet on one direction when you can prepare for both? It’s a headache-free solution to the old “what-if” dilemma. Seriously, this approach has amped up my trading results, and the sense of control it gives – just phenomenal.

Handling Market Momentum

So, how do Breakout OCO orders help me catch that wave of market momentum? Simple! It’s all about being ahead of the game. When there’s a whisper of a breakout, I set my orders, sit back, and let the market conditions do the heavy lifting. Time and time again, I’ve seen how a well-placed Breakout OCO order scoops up the opportunity the moment it arises, locking in profits before most have even started their analysis.

Feeling that rush when the breakout hits and my order is executed is indescribable. I mean, who doesn’t love the satisfaction of a plan coming together at the right moment, right? It’s that instant validation of my market read. And let’s not ignore the flip side – protection against false breakouts. Ever been caught out by a sneaky price spike that fizzles to nothing? Yeah, not fun. With Breakout OCO orders, I avoid getting snagged in those traps. If the breakout doesn’t hold, I’m still in the clear, unscathed and ready for the next real move.

Optimizing Trading Outcomes

Alright, real talk – nobody hits the bullseye with every shot, but with Breakout OCO orders, I’ve fine-tuned my aim. It’s all about optimizing those trading outcomes. By setting up my orders around those pivotal price points, I’m leveraging both potential breakout directions. This takes some serious edge off the risk and boosts my chances of a win. And we all know, in this trading biz, an edge is what separates the winners from the rest.

Having these orders in my toolkit means I’m navigating the market’s ebbs and flows with a savvy edge, turning uncertainty into a strategic advantage. I’ve waved goodbye to the days of second-guessing and hesitancy. Now, it’s all about calculated moves and sharper tactics. Sure, the market’s a tough nut to crack, but tools like Breakout OCO orders just might be the nutcracker we’ve all been looking for.

Implementing OCO Orders Practical Strategies and Techniques

Implementing OCO Orders Right out the gate, let’s talk about how you can incorporate these clever little devices known as One-Cancels-the-Other orders into your trading. Honestly, it’s like having a little bit of magic in your pocket, or in this case, your portfolio. You’re essentially laying out a game plan for your trades, where you decide the precise points for your victories and your backup plans for those not-so-stellar days.

Let me walk you through it; suppose you’ve got your eye on a particular crypto asset - you know, the one that gets your heart racing with its wild price swings. You pinpoint a price that’ll have you grinning from ear to ear if it hits – that’s your take-profit order. Then, there’s that number that’ll save you from a serious case of trader’s remorse – yep, that’s your stop-loss.

By using OCO orders, you give the green light to only one of these to run the show. The moment one gets triggered, the other waves goodbye, and you’re either pocketing some sweet gains or stopping the bleeding before it gets too messy. And the best part? You get to step away from the screen without fretting over every tick – ‘cause let’s face it, there are only so many heart palpitations one can handle in a day.

Practical Strategies and Techniques Now, nailing down the technique is where it gets juicy. You’ve got to master the art of setting those OCO orders like a pro. First up, you gotta be in tune with the market’s rhythm. Read those charts like it’s your favorite novel, looking for the plot twists and turns that can hit your sweet spots or your pain thresholds.

Then, it’s about defining your risk tolerance – that’s the level of market drama you’re willing to stomach. This isn’t just numbers; it’s about how much unease you can handle without turning into a nervous wreck. You set those stop-loss and take-profit orders based on a mix of cool-headed analysis and gut instinct about where the market’s headed.

Here’s the kicker: avoid getting too cozy with round numbers. Everybody loves them, which often turns them into psychological magnets for the masses. Be crafty, slide those orders in at slightly offbeat prices.

And stay nimble, my friend. The market’s a shifty creature. Keep an eagle eye on the bigger financial picture ‘cause it’ll sneak up on you with news or trends that could compel a strategic retreat or advance. Adapting your OCO orders to the ever-evolving market scenario? That’s what separates the veterans from the rookies. It’s all about making those adjustments that keep you in the sweet spot of risk management and potential profits.

Targeting Price Breakouts

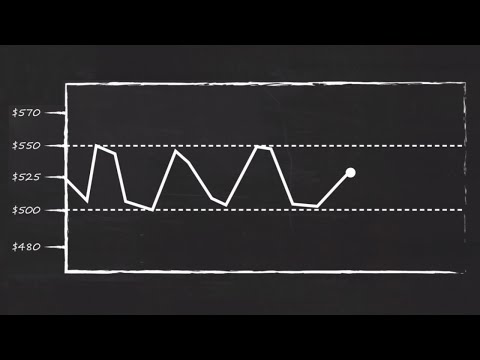

As someone who’s got their finger on the pulse of the market, I totally get how essential it is to catch those breakouts when they happen. Seriously, timing is everything, and that’s where One-Cancels-the-Other orders or OCOs come in handy – they’re like your trusty sidekick in the superhero world of trading. Suppose you’re eyeing a cryptocurrency that’s been playing it coy, just teetering on the edge of a major price move. You don’t want to miss out, right? So, you set up an OCO order. Basically, you’ll place two orders: one above the current resistance if you reckon the price is gonna soar, and another below the support if it looks like it might tank. Whichever way the cookie crumbles, you’re covered.

Now, let’s say the market decides to party and your crypto starts to breakout to the upside – boom! Your buy order gets triggered, and you’re riding that wave. But what about the sell order? Well, it just cancels itself out, so you don’t have to stress over it. I can’t overstate how cool this is – it’s like having a plan A and plan B in one go, and you don’t have to hover over your computer all day. It’s a nifty way to play it smart with price breakouts and make sure you’re not left in the dust.

Deciding Between Two Cryptocurrencies

Heads or tails? Choosing the better coin feels almost like that sometimes, doesn’t it? When you’re faced with the option of investing between two cryptocurrencies and you’re clawing at your hair, not knowing which one will blast off to the moon, that’s where the power of One-Cancels-the-Other (OCO) orders sweep in to save the day.

Let’s cut to the chase - setting up an OCO order is like having your cake and eating it too. You get to lay out your plans for both currencies, and as soon as one starts to shimmer and shine, the other order gets dropped faster than a hot potato. Now, I’m not just blowing smoke here; this strategy seriously amps up your trading game. Instead of agonizing over the charts like you’re reading tea leaves, these orders let you play on both sides. And if the market sways in favor of one currency, boom, you’re already riding the wave, while sidestepping the risk on the other. It’s like a trader’s little secret weapon for hedging your bets and keeping your cool when the market’s running wild.

The nitty-gritty is all about those entry orders you set up for each asset. Pick your spots - one high, one low - and let the market decide. The beauty is that you’re not hitching your wagon to just one star. If one currency decides to take a nosedive, your other order is there, primed and ready, to pull you back from the brink. It’s a slick move for those who want to grab the bull by the horns and direct their investment without letting emotions make a mess of things.

Executing OCO Orders Practical Considerations and Best Practices

Executing OCO Orders

I’ve been around the block with different trading platforms, and it never ceases to amaze me how they each have their own quirks—and that goes double for setting up One-Cancels-the-Other (OCO) orders. It’s like, each platform has its own personality, you know? If you’re not cozy with how your platform handles OCO orders, you might end up with some unintended consequences—like orders not executing when you expected them to, or at all!

But let me tell you, once you get the hang of it—oh boy, it’s smooth sailing. Creating these orders can be a bit like solving a puzzle; ensuring that as one part moves, the other freezes in place. Some platforms do make it easier than others, with intuitive interfaces that guide you through the process—like a trusty co-pilot.

Here’s the kicker though, just because it seems straightforward doesn’t mean you can get complacent. Vigilance is your best friend. What I do is I always double-check the details. Are the orders correctly paired? Did I set the right conditions? And this might sound basic, but confirm and reconfirm those entry and exit points—trust me, it pays off.

Practical Considerations and Best Practices

On the practical side of things, my mantra is: know your tools, and know them well. That means diving into the nitty-gritty of whatever trading platform I’m using. Like, what if it’s more manual than what I’m used to? Well, I take that as a personal challenge. Adapting to manual pairing of orders means I gotta be on top of my game, keep a vigilant eye, and have my ducks in a row.

And hey, it’s not just about setting up the OCO orders correctly. It’s also about being smart with your choices. One best practice that I live by is to always, and I mean always, use limit orders within my OCO strategies. You don’t want to be at the mercy of market fluctuations that could turn your trade into a roller coaster ride you weren’t ready for.

Another hot tip? Stay updated with the market conditions—seriously, they can be as unpredictable as the weather. You want to tailor your strategy to what the market’s doing. That means being flexible and ready to adjust your OCO orders when the need arises. It’s a bit like surfing; you have to ride the wave, not fight it.

And here’s a little something I’ve learned from experience: Don’t get too cozy with just one strategy. The market loves to throw curveballs, and getting too comfortable with a single approach can leave you striking out more often than not. Mix it up! Keep adapting—that’s the secret sauce to rocking those OCO orders like a pro.

Advantages and Considerations

Now, let me dive straight in and chat about the perks of One-Cancels-the-Other (OCO) orders. They’re a real game-changer when you’re trying to navigate the fast-paced world of trading, especially in the crypto market, where the tide can turn in the blink of an eye. We’re talking enhanced risk management here, people! What could be better than having a system in place that lets you set your profit targets and stop-losses simultaneously? It’s like having your cake and eating it too. As soon as one part of the order is triggered, the other part waves goodbye. It’s a savvy way to automate your trades so you can chill and let the system do its thing, which, believe me, is a sweet relief for those who can’t stick around to babysit their screens all day.

But hey, it’s not all sunshine and rainbows with these OCO orders, and I gotta keep it real with you. We’ve gotta ponder on a few considerations. For starters, those pesky partial fills can throw a wrench in your plans. Sometimes only a portion of your order is executed, and that’s kind of a letdown, right? Speed is also of the essence. The crypto market waits for no one, and neither will your OCO orders. If your platform is a step behind, or if you’re not up to speed with how to properly set them up, you might as well be trying to catch a hologram. It can be tricky. And let’s not forget about those platform limitations – not all platforms support OCO orders, so you’ve gotta make sure you’re not rowing your boat with a spaghetti noodle here.

To wrap it up, OCO orders can be a killer strategy for your trading arsenal – they streamline the process and help keep you from pulling your hair out. But remember, it’s crucial to be aware of the potential hiccups. A little bit of due diligence goes a long way to ensure you’re getting the best out of your trades while keeping those risks at arm’s length.

Conclusion Unleashing the Power of OCO Orders

Boy, let me tell you, getting the hang of One-Cancels-the-Other (OCO) orders is kinda like finding that secret sauce that spices up your trading strategies. As a seasoned trader, I’ve seen time and again how a well-placed OCO order can seriously make or break a trading plan. It’s all about harnessing the power of these orders to open up a treasure trove of possibilities in the market.

Now, when you’re in the thick of all the market mayhem, an OCO order can be your best pal. It’s like having a safety net while walking a tightrope—you get to place a pair of orders, and if one triggers, the other kicks the bucket, no questions asked. This brilliant setup gives you the freedom to play both sides of the field, going after profits while keeping those pesky losses at arm’s length.

Sure, there are a few caveats to keep in mind—no trading tool is foolproof, am I right? But, if you take the time to learn the ins and outs, implement them thoughtfully in sync with the market’s mood swings, you can steer clear of a lot of heartache. And trust me, nothing feels better than knowing you’ve got a plan that adjusts on the fly, keeps you in the game, and cuts the cord on deals heading south.

In summary, folks, OCO orders are like a Swiss Army knife for traders. Learn it, love it, live it. I’m telling you, once you get the gist of these bad boys, you’ll wonder how you ever traded without ‘em!

Final Verdict

Oh man, OCO orders, let me dive right into that. So, you’ve got this tool in your trading arsenal, right? And it’s like having a super smart assistant who’s got your back, no kidding. Imagine you’re juggling two potential moves in the market—like, you want to snag a profit at a price that’s soaring, or bail out before you hit a loss that’s too much to stomach. That’s where One-Cancels-the-Other orders strut in.

When you set up an OCO, you’re essentially placing a pair of orders, and it’s a real beauty because when one order is executed, the other gets canceled automatically. Poof! Just like that. It’s a way to play defense and offense at the same time in the unpredictable crypto game. You’re locking in profits while limiting risks without having to stick to your screen day and night. I mean, you gotta sleep, right?

I’ve gotta say, after diving into these, it’s pretty clear they’re a game changer. They take a load off your mind, knowing you won’t miss out on a good exit or get slammed by a bad turn, especially when the market’s as fickle as a cat on a hot tin roof. It’s like having a plan A and plan B, and automatically switching gears when needed. Now, isn’t that something?

Frequently Asked Questions

What exactly is an OCO order in trading?

OCO, or One-Cancels-the-Other, is a pair of orders combining a stop order with a limit order on an asset. Once one is executed, the other is automatically canceled. It’s like telling your broker, “Do this for me, but if something else happens first, forget that and do the other thing.”

How do OCO orders benefit traders?

OCO orders are a real convenience! They let you set a profit target and stop-loss simultaneously without having to monitor the market every second. Think of them as a two-for-one deal in risk management.

Can OCO orders be used in all markets?

Mostly, yes. They’re popular in forex, stock, and futures markets. Just a heads-up, though: not all brokers or exchanges offer them, so better check with yours.

What happens if prices move quickly and both orders of an OCO are triggered?

Ah, that’s a rare scenario, like both elevator buttons lighting up! But don’t worry; once one order is executed, the other one is canceled immediately, even if the market is moving at lightning speed.

Do OCO orders expire?

Yup! These orders aren’t timeless. They usually expire at the end of the trading day, but many platforms let you set a custom expiration date. Always good to keep track, so you don’t get a surprise.

Can I set multiple OCO orders on the same stock?

Sure thing! It’s like playing chess with the market — strategizing multiple moves ahead. Just ensure you’re not overcommitting capital.

Are OCO orders guaranteed to be executed?

Life doesn’t give guarantees and neither do OCO orders. They reduce the need to babysit your trades, but if the market doesn’t hit your specified prices, they won’t be executed.

Is there a risk of slippage with OCO orders?

Indeed, there is. Slippage is like that sneaky person who cuts in line. It happens during rapid price changes, so your order might not be executed at the exact price you wanted.

What’s the difference between OCO and bracket orders?

They’re cousins in the order family. Bracket orders come with a profit and loss stop, while OCO is more about setting up two distinct conditional orders. Both aim to help you manage risk.

How do I decide on the price points for my OCO orders?

It’s a bit like setting up a lemonade stand — you’ve got to do your homework. Look at technical indicators, historical data, and your own risk tolerance to pick the sweet spots.

Comments